UberEats is Crippling Restaurants and Booking.com Hotels, Is Health Care Next?

As the digital economy continues to build momentum, marketplaces are forming in all fields of industry. While to the consumer who values convenience, nothing seems amiss, there is a sinister aspect to how these platforms impact businesses, placing Australian healthcare in a precarious position.

At first glance, marketplaces are seemingly good things. They take businesses by the hand, promising more customers, more sales, and a bigger podium to parade their brand. But once aboard, the grip often tightens, making it increasingly difficult for businesses to leave.

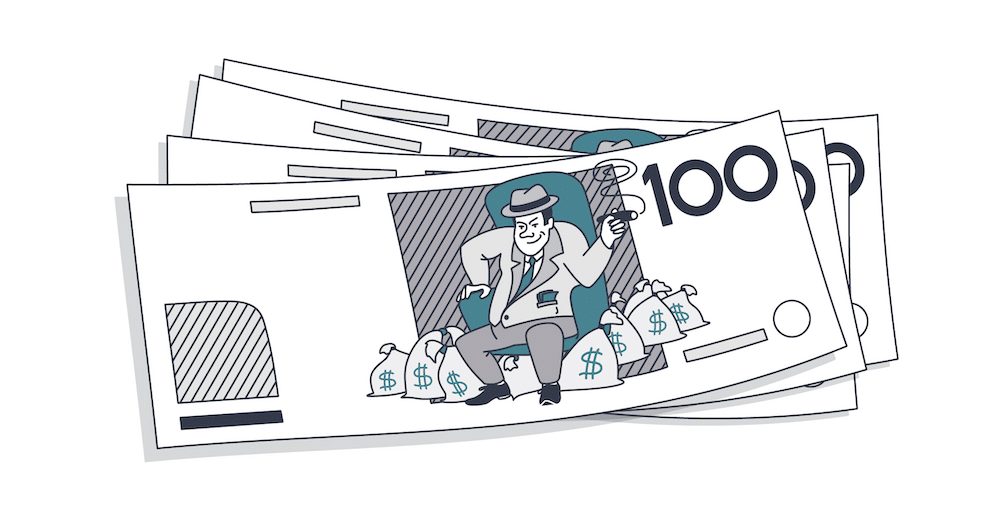

A cautionary lesson from UberEats

Take UberEats. If you’re like most Australians, you love the platform for the convenience and affordable access to food delivered to your door. But that’s because you’re not a restaurateur.

Geoff Bannister, owner of Sydney-based doughnut business, Dr Dough, revealed in a recent interview that half of restaurants “are not actually making any money” on UberEats and its rival Deliveroo, with the food delivery platforms charging restaurants commissions of 30-35%.

Bannister shared,

“If someone’s taking 30 to 35 percent of your margin, it doesn’t make sense at all… I just believe the whole model needs to change. There has to be a tipping point.”

Bannister says that many restaurateurs are short-sighted and welcome all the additional business that they generate through the platforms, but don’t crunch the numbers to see if the model is economically sustainable.

“Anyone partnering with UberEats or Deliveroo, you really need to know your numbers and what it’s costing you to build and make any of your products.

“Whenever I launch a new product or if my wholesale costs go up, I look at it and say, ‘Is it worth selling through delivery?’ And if it’s not, we don’t sell it. You need to be really cautious of that, because everyone knows margins in the food industry are tight as they are,” he said.

Monopolies who don’t play fair

While marketplaces are continually trying to improve the customer experience in order to generate more usage, there is very limited incentive for these same platforms to help out their vendors. Especially when they have monopolised the market.

In this part of the new digital economy, there’s a winner-take-all mentality when it comes to competition and market share. For example, in August 2018, Foodora announced they were ceasing Australian operations, conceding the food delivery field to Deliveroo and UberEats.

This lack of competition means the big players only get bigger, and as time passes it only becomes more difficult for new competitors who may treat their vendors better to enter the space.

“Businesses generally have zero leverage if a marketplace decides to increase fees. And if businesses do decide to jump ship, the platforms often make it very hard for them to do so.”

This is a common complaint by hoteliers who are being forced to compete on booking.com. In a recent interview with the ABC, Bendigo motel owner Charlie Loftus discussed what can happen when a business questions the policies of the hotel booking marketplaces.

“That can be a very dangerous thing to do, to identify your property and speak out against any of these sites because they have nasty little ways of dealing with agitators… just to drop us down their list and put us on the third page or fourth page of their site,” Loftus said.

“That’s when you might have to do things like pay a higher commission [or] offer discounts through their site that you don’t want to do.”

Eventually, businesses feel like hostages who have to be compliant otherwise they will potentially lose huge amounts of revenue.

This type of unfair play is not limited to hotel marketplaces. The ACCC recently stepped in and forced UberEats to amend contracts with restaurants that previously allowed the company to deduct refunds from the restaurant, even when the problem with the meal may not have been the fault of the food outlet.

Eventually these monopolies get so large that consumers also start to feel the pinch. A recent article, Hidden cost restaurants pass on to customers using food delivery apps, revealed this fact by showing consumers were often paying 20% more, excluding the delivery fee, when using platforms like UberEats.

The marketplace threat to healthcare

Today, these same marketplace webs are being spun in healthcare. Platforms that offer to send patients to medical centres in exchange for a fee have a vice grip on many. With the promise of new patients and threats of damaging their reputations if they leave, many medical centres feel pressured to remain on such platforms as the fees only go up.

Like the restaurant and hotel space, participation on such platforms is only encouraging a giant race to the bottom where there will only be one eventual winner – the platform itself.

“Beyond this race to the bottom, there is an even greater concern. A concern that doesn’t affect hotels or restaurants anywhere near as much as medical centres, and that is the permanent damage a clinic’s participation in a marketplace can do to their reputation.”

After all, when a clinic uses the marketplace, so do their patients. They receive a booking confirmation from the marketplace as well as their reminders and recalls. Some patients even receive emails asking for feedback.

If such a patient were to suddenly become concerned about the motives of the marketplace, they are likely to tie this concern to the medical centre. An action that could permanently tarnish a clinic’s reputation. This is a much bigger concern than any hotel or restaurant owner has to worry about. After all, people place their health information above all else.

Winning in this brave new world

Marketplaces do everything they can to make it hard to exist without them. The stronger their stranglehold, the greater their profitability. But there is an out. And that’s to recognise that there is one thing that makes medical centres different to restaurants and hotels… the stakes.

Sure, a nice hotel at a discounted price or a tasty meal delivered to your door is a nice-to-have, but a good patient experience, well, that’s a necessity. If you provide a good patient experience, patients will be loyal to you whether or not you are listed on a marketplace.

Especially when we consider that before marketplaces existed, patients found a way to be loyal, even if it meant waiting on hold to book an appointment. It shouldn’t be any different today, especially when there are many platforms offering online bookings. It just takes a bit of education to explain which booking platform is your preferred provider and why.

And when it comes to missing out on new patients by not playing ball in the marketplace? Well, that’s a bit of a myth, that marketplaces do their best to keep quiet. You can read more about the myth here: The ‘New Patient’ Myth – Why Do 9% of Patients Steal 90% of Our Attention?

“The fact is, just 9%^ of bookings on healthcare marketplaces are new patients, and most of these visitors already knew the name of the practice or doctor before landing on the site.”

The remaining 91%^ are made by existing patients who simply used the marketplace to get to the clinic because it’s the route they were forced to take last time. If the clinic wasn’t listed on the marketplace, the patient would most likely have used the clinic’s website or a booking link attached to their Google My Business listing to make their booking.

The truth is, medical centres can thrive without marketplaces. Mostly because, unlike a fast meal or a cheap bed, word-of-mouth plays a much bigger role in how patients choose their doctor. In fact, with 33%* of new patients coming from word-of-mouth and just 4%* coming from marketplaces, word-of-mouth proves to be 8 times more powerful than marketplaces at bringing in new patients. This is food for thought, especially when you consider that in this day and age, marketplaces can actually do more damage than good to word-of-mouth.

Sources

^ https://practices.healthengine.com.au/